| This is the first time this home is hitting the market and its unique structure/layout and offering will not last. Large/ Spacious 2-Family home in a very desirable neighborhood located within two miles of metro north, with many scenic parks, great restaurants and sought after school system. An amazing opportunity for owner occupied scenario – live in one and rent the rest, or rent the entire home as an investment. Simply a great location and space! 3 bedroom unit on top floor and a spacious 2 bedroom w/bonus room that lives like a 3 bedroom on 1st floor. This unit has a mother in law suite attached to it as well. This home has been extremely well maintained from when the first brick was laid down to all the new updates like new roof, deck, hardwood floors and fenced in yard. In addition to the 2 car garage and huge driveway that leaves more than enough parking for yourself and/or tenants, there is another large driveway on backside of home with a 1 car garage w/oversized storage space

This one is sold, but there are more opportunities out there. Thinking about selling or buying? Call me at 917-715-2079🏡 |

Here’s what a $990K multifamily buys you in Valhalla!

Here’s what $560K buys you in Hopewell Junction!

If you’re looking for a beautiful, bright, turnkey end unit Townhome, look no further than this Toll Brothers new build- 2019/2020. Open floor plan features kitchen with huge island and granite counters open to the great room and dining room. Large primary bedroom with luxurious master bath and walk in closet. Two additional bedrooms, family bathroom and convenient laundry room complete the second level. Full unfinished basement perfect for your finishing touch. And tons of storage! Enjoy maintenance free living including lawn care & irrigation. Clubhouse w/fitness center and Kitchen, Pub/Tavern room, pool, tennis & sports courts. Great location-just 15 minutes from the Metro North train station, near the Taconic State Parkway/Interstate 84. The community walking and biking trails offer access to The Dutchess County Rail Trail. Come see what Dutchess County has to offer.

This one is sold, but there are more opportunities out there. Thinking about selling or buying?

Call me at 917-715-2079🏡

Here’s what $525K buys you in Stamford!

Welcome to this sunny, bright, Colonial in the Waterside neighborhood of Stamford. Enjoy sitting on your front porch admiring your rosebush lined front yard. This lovely home boasts 3 Bedrooms, 2 Full Baths, Family Room w/slider to oversized Deck, Living Room, Den/Office, and Formal Dining Room. The home offers high ceilings, old style molding throughout, glass doorknobs, and hardwood floors. Don’t let this Old World Charmer pass you by. The possibilities are endless.

This one is sold, but there are more opportunities out there. Thinking about selling or buying?

Call me at 917-715-2079🏡

Here’s what $1.7M buys you in Scarsdale!

This charming center hall Colonial in the sought after Greenacres neighborhood of Scarsdale is on a woodsy two-thirds acre plot. First level features a cozy library, gracious living room with wood burning fireplace, bright sun porch/family room, formal dining room, powder room and eat-in kitchen with adjacent laundry. There is a spacious deck off the kitchen overlooking a wooded back yard. Second level contains a master bedroom “suite” and bath, three additional bedrooms, one full and one half bath. Level three consists of two bedrooms and two baths, a storage room/sleeping porch, and pull down access to the attic above. Three room basement is unfinished. There is garage parking for three cars. This delightful house awaits a family seeking private living in an outstanding suburban community, minutes away from excellent schools, the nearby village, and a quick trip on Metro North to NYC. Room here for several home offices!

This one is sold, but there are more opportunities out there. Thinking about selling or buying?

Call me at 917-715-2079🏡

What Does a Title Company Do? A Guide for First-Time Homebuyers By Tara Mastroeni

If you’ve recently gone under contract to buy a home, you’ve probably been told by your real estate agent to find a title company. In that case, you may be wondering what does a title company do? And what is a “title,” anyway?

In the real estate industry, “title” refers to the legal right to ownership of a property. This title is transferred from a seller to a buyer through the deed to the property. In most cases, the person who holds the deed to the property also holds title and is considered its rightful owner.

Additionally, the new owner must be able to own the property “free and clear,” which means that any other claims to ownership must be resolved before a new transfer of ownership can take place. Some common title problems might include an ex-spouse whose name is still on the deed, or financial claims like a lien or unpaid taxes on the property.

“It’s the title insurance underwriter’s job to make sure the purchaser doesn’t inherit unwanted problems such as liens, claims, or unpaid taxes,” explains Kathy J. Kwak, chief operating officer of Proper Title in Chicago.

The title company offers protection against these issues through a title insurance policy.

“This policy ensures that the seller or owner has the right to sell the land and that any problems have been cleared up,” Kwak adds.

What are the responsibilities of a title company in a real estate transaction?

Here’s a rundown of the various roles and responsibilities fulfilled by a title company in a transaction.

Conduct a title search: Once a title company receives an executed agreement of sale, it performs a title search. During this search, it looks for anything that could impede the buyer’s rightful ownership of the property. Specifically, it looks for any existing mortgages, liens, judgments, unpaid taxes, and restrictions due to easements.

Order a property survey: At the same time, the title company will likely order a property survey from a third-party provider. This survey defines the boundaries of the plot of land where the home is located. It also determines whether the home fits within those boundaries or if there are any encroachments that may affect the new buyer’s ownership claim.

Put together a title report: After the title search and property survey have been completed, the title company puts together a title report, which is also known as a “title abstract.” This report spells out the results of the title search, including any issues that need to be resolved before the title for the property can be transferred to a new owner.

Issue title insurance: Once any existing issues have been resolved, the title company issues a title insurance policy. In particular, title insurance protects the recipient from financial harm in any legal issues that result from a dispute over the ownership of the property.

Hold escrow: In addition to providing a title search and insurance, many title agents will also serve as escrow agents. In real estate, the escrow agent is a neutral third party that is in charge of holding any funds that are supposed to be exchanged between the parties in the transaction.

Typically, an escrow agent will be in charge of holding the buyer’s earnest money deposit. However, if any other funds need to be exchanged after closing, such as any negotiated funds for repairs, the escrow agent will hold those as well.

Facilitate closing: Lastly, in title states, the title agent also usually facilitates the settlement. The title agent will make sure that all the paperwork has been signed and that the funds have been properly disbursed.

What are the different types of title insurance?

When buying a home, you need to understand that there are two different types of title insurance. There is a lender’s title insurance policy and an owner’s title insurance policy. Here is a look at the differences between them.

Lender’s title insurance: Typically, buyers will be required to purchase a lender’s title insurance policy as a condition of their mortgage. As the name suggests, this policy protects the lender’s financial interest in the property if there’s ever another claim to ownership.

Owner’s title insurance: Meanwhile, an owner’s title insurance policy protects the owner if there is ever a legal dispute over who is the rightful owner.

Usually, purchasing one of these policies is optional. However, it’s generally considered to be a good idea. After all, you never know when a dispute may arise and it’s better to be safe than sorry.

Can you shop around for a title company?

When it comes to title insurance, buyers usually wonder if they can shop around for a title company. The answer to this question depends on where you live. In most cases, it does make sense to shop around for title insurance. However, in some states, shopping around does not make much of a difference.

Pennsylvania, for example, is what’s known as an “all-inclusive” title state. Title companies in the state must charge one all-inclusive fee for their services. This fee is generally uniform across the board. In other states, title companies can charge separate fees for each of their services.

Here’s what $1.425M buys you in Purchase, NY!

Welcome to The Crossings of Blind Brook. Luxurious single floor living and a maintenance free lifestyle in this exclusive 24/7 gated community in Purchase, NY. This beautifully manicured community offers concierge like amenities and a lock an go lifestyle. No detail was spared in this renovation. An open concept floor plan with a gourmet kitchen with quartz countertops, Viking stove, Viking microwave, Bosch dishwasher and top of the line GE wall oven and GE fridge/freezer. Make your morning coffee and toast in your walk in pantry and walk out to your patio and brand new salt water pool. The primary bedroom suite has an expansive dressing area, separate toilet room and sink and large glass shower. In addition you have two additional bedrooms and baths, all stylishly redone. The Crossing of Blind Brook is conveniently located close to most major highways, fabulous dining and shopping in either White Plains, Rye or Greenwich CT.

This one is sold, but there are more opportunities out there. Thinking about selling or buying?

Call me at 917-715-2079🏡

HOW TO GET READY FOR RETIREMENT

For most people, retirement feels like a long way off. But, if you don’t start preparing as early as possible, you may find yourself in a place of financial insecurity when the time does come. To avoid this, consider implementing the following tips.

- Calculate your target savings. In general, it’s recommended that you save between 10 to 15 percent of your income for retirement. However, you can always use an online savings calculator to determine the amount you need to save for your specific needs and goals.

- Contribute to your employer’s retirement savings plan. Does your job offer a 401(k), traditional IRA, or Roth IRA? Sign up and start saving as soon as they allow you to. It’s recommended to set up automatic paycheck deductions and, once the money is in your retirement fund, don’t touch it.

- Take advantage of employee benefits. Many employers offer matching which generally requires you contribute a certain percentage of each paycheck and your company will then contribute a matching amount with funds of their own. They might also offer health savings or flexible savings account. By contributing to these accounts, you reduce your amount of taxable income, allowing you to save more money.

- Pay off your debts. Start by paying off any high-interest credit card debt first. Then look at other debts, such as student loans and car payments, and make a plan for paying those off incrementally.

- Reduce daily spending. Although this feels like a no-brainer, spending your money thoughtfully now can make a big impact later. Seek out areas of your life where you can

Selling Your House? Make Sure You Price It Right.

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR):

- Homes typically sell within 17 days (compared to 26 days one year ago).

- The average home sold has five offers to pick from.

- 54% of offers are over the asking price.

Because so many buyers are competing for so few homes, bidding wars are driving up home prices. According to an average of leading expert projections, existing home prices are expected to increase by 8.9% this year.

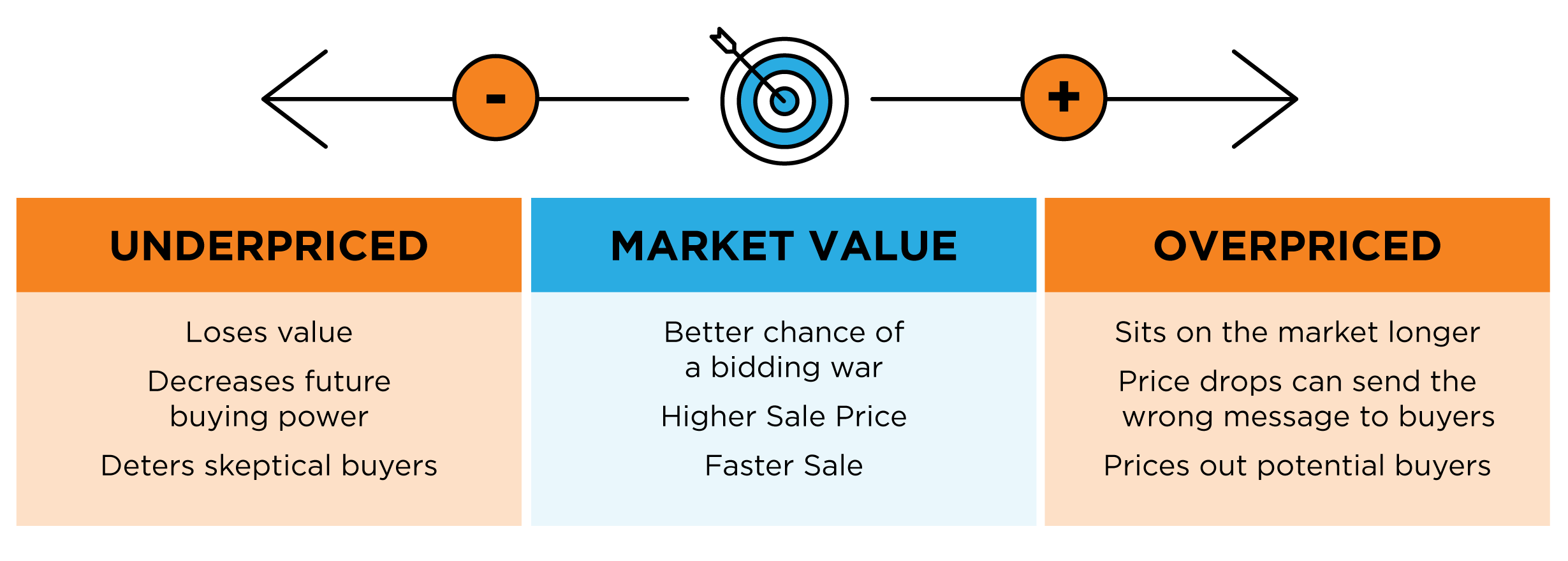

Yet even in today’s red-hot sellers’ market, it’s important to price your house right. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

Why Pricing Your House Right Matters

Here’s the thing – a high price tag doesn’t mean you’re going to cash in big on the sale. While you may be trying to maximize your return, the tradeoff may be steep. A high list price is more likely to deter buyers, sit on the market longer, or require a price drop that can raise questions among prospective buyers.

Instead, focus on setting a price that’s fair. Real estate professionals know the value of your home. By pricing your house based on its current condition and similar homes that have recently sold in your area, your agent can help you set a price that’s realistic and obtainable – and that’s good news for you and for buyers. When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

Bottom Line

When it comes to pricing your house, working with a local real estate professional is essential. Let’s connect so we can optimize your exposure, your timeline, and the return on your investment, too.

Real Estate Is Still Your Best Investment

Americans Choose Real Estate as the Best Investment [INFOGRAPHIC]

![Americans Choose Real Estate as the Best Investment [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/05/20143944/20210521-MEM-1046x2001.png)

Some Highlights

- For the eighth year in a row, real estate maintained its position as the preferred long-term investment among Americans.

- Real estate has been gaining ground against stocks, gold, and savings accounts over the last 11 years and now stands at its highest rating in survey history.

- Let’s connect if you’re ready to make real estate your best investment this year.

What Are the Benefits of a 20% Down Payment?

If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment. Many people may think it’s 20% of the loan to secure a mortgage. While there are plenty of lower down payment options available for qualified buyers who don’t want to put 20% down, it’s important to understand how a larger down payment can have great benefits too.

The truth is, there are many programs available that allow you to put down as little as 3.5%, which can be a huge benefit to those who want to purchase a home sooner rather than later. Those who have served our country may also qualify for a Veterans Affairs Home Loan (VA) and may not need a down payment. These programs have really cut down the savings time for many potential buyers, enabling them to start building family wealth sooner.

Here are four reasons why putting 20% down is a good plan if you can afford it.

1. Your interest rate may be lower.

A 20% down payment vs. a 3-5% down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate they’ll likely be willing to give you.

2. You’ll end up paying less for your home.

The larger your down payment, the smaller your loan amount will be for your mortgage. If you’re able to pay 20% of the cost of your new home at the start of the transaction, you’ll only pay interest on the remaining 80%. If you put down 5%, the additional 15% will be added to your loan and will accrue interest over time. This will end up costing you more over the lifetime of your home loan.

3. Your offer will stand out in a competitive market.

In a market where many buyers are competing for the same home, sellers like to see offers come in with 20% or larger down payments. The seller gains the same confidence as the lender in this scenario. You are seen as a stronger buyer with financing that’s more likely to be approved. Therefore, the deal will be more likely to go through.

4. You won’t have to pay Private Mortgage Insurance (PMI)

What is PMI? According to Freddie Mac:

“PMI is an insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%. Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As mentioned earlier, when you put down less than 20% when buying a home, your lender will see your loan as having more risk. PMI helps them recover their investment in you if you’re unable to pay your loan. This insurance isn’t required if you’re able to put down 20% or more.

Many times, home sellers looking to move up to a larger or more expensive home are able to take the equity they earn from the sale of their house to put down 20% on their next home. With the equity homeowners have today, it creates a great opportunity to put those savings toward a 20% or greater down payment on a new home.

If you’re looking to buy your first home, you’ll want to consider the benefits of 20% down versus a smaller down payment option.

Bottom Line

If you’re thinking of buying a home and are already saving for your down payment, let’s connect to discuss what fits best with your long-term plans.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link